Some thoughts on Apple from a somewhat tech guy:

Apple announced details of it's new VR Headset and the biggest/controversial piece was that it's headset is rumored to be $2,000 to $2,500. This is a lot more than conventional VR headsets like the Meta Oculus Quest 2 which is now $400 (was $300 a month ago but they raised the price).

Been thinking a bit about this, as I've used the HTC Vive extensively back in 2017, had the Samsung VR Headset, and just recently purchased the Quest 2 (while it was still $300), and being a tech guy, I get into this stuff a little bit. I think we haven't even begun to scratch the surface of VR. It's still very much in it's infancy, and almost everything about it can, and will be improved in the coming years. Everything from video quality, headset features, sound, content, training, camera use.. you name it.

IDK.. something tells me Apple's headset might wind up being it's next great product, like the iPod and iPhone. And I think the price tag is genius for two reasons: 1. the specs are already rumored to blow everything out of the water, what with a industry leading 12 cameras in the headset and 2. Apple fans LOVE the ecosystem and the "luxury" of the brand, and this price might just drive people to buy it.

It may not be the first iteration or even the second.. but once VR becomes more mainstream, this could be the device that everyone wants for Christmas. We've exhausted the smartphone market, the next thing that could be a boom, IMO, would be VR, a really untapped area that can grow in dozens of ways.

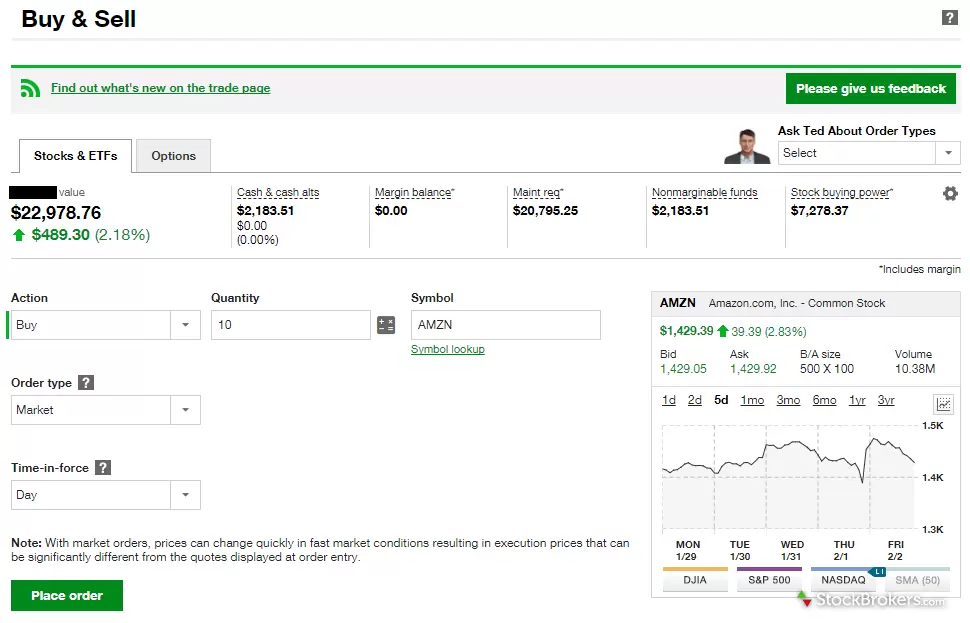

So I feel like Apple stock might be a great pickup. Also, I HATE Apple products as a SysAdmin, just in case anyone thinks I'm an Apple fanboy. I guess I just think there could be a good stock opportunity here.

Curious to see what others think, and if anyone here has given VR a try.