Cramer and many “gurus” never or rarely mention debt or gross margin, yet both items (albeit GM doesn’t apply to all companies) are critical. I understand interest rates are low, but mountains of debt are a hurdle regardless.Revenue and earnings growth are big no matter what business it is. In these times, I want to own few of the companies in massive debt without much growth so the ratio of debt/equity is something I look at. In addition, I look at how their peers are doing. I can stomach an expensive P/E ratio if a company is best of breed in their sector because these type businesses always get a higher valuation.

Colleges

- American Athletic

- Atlantic Coast

- Big 12

- Big East

- Big Ten

- Colonial

- Conference USA

- Independents (FBS)

- Junior College

- Mountain West

- Northeast

- Pac-12

- Patriot League

- Pioneer League

- Southeastern

- Sun Belt

- Army

- Charlotte

- East Carolina

- Florida Atlantic

- Memphis

- Navy

- North Texas

- Rice

- South Florida

- Temple

- Tulane

- Tulsa

- UAB

- UTSA

- Boston College

- California

- Clemson

- Duke

- Florida State

- Georgia Tech

- Louisville

- Miami (FL)

- North Carolina

- North Carolina State

- Pittsburgh

- Southern Methodist

- Stanford

- Syracuse

- Virginia

- Virginia Tech

- Wake Forest

- Arizona

- Arizona State

- Baylor

- Brigham Young

- Cincinnati

- Colorado

- Houston

- Iowa State

- Kansas

- Kansas State

- Oklahoma State

- TCU

- Texas Tech

- UCF

- Utah

- West Virginia

- Illinois

- Indiana

- Iowa

- Maryland

- Michigan

- Michigan State

- Minnesota

- Nebraska

- Northwestern

- Ohio State

- Oregon

- Penn State

- Purdue

- Rutgers

- UCLA

- USC

- Washington

- Wisconsin

High Schools

- Illinois HS Sports

- Indiana HS Sports

- Iowa HS Sports

- Kansas HS Sports

- Michigan HS Sports

- Minnesota HS Sports

- Missouri HS Sports

- Nebraska HS Sports

- Oklahoma HS Sports

- Texas HS Hoops

- Texas HS Sports

- Wisconsin HS Sports

- Cincinnati HS Sports

- Delaware

- Maryland HS Sports

- New Jersey HS Hoops

- New Jersey HS Sports

- NYC HS Hoops

- Ohio HS Sports

- Pennsylvania HS Sports

- Virginia HS Sports

- West Virginia HS Sports

ADVERTISEMENT

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Stock Advice Thread

- Thread starter dgtatu01

- Start date

This is true. I hear operating margin a lot more than gross margin and debt/equity. But then again CNBC is IPO, ETF, technology and hedge fund whale focused most of the time these daze!Cramer and many “gurus” never or rarely mention debt or gross margin, yet both items (albeit GM doesn’t apply to all companies) are critical. I understand interest rates are low, but mountains of debt are a hurdle regardless.

P/E's are good quick reference. I love to to see a revenue growth trend.

But probably my biggest factors are:

1. Can I understand the business?

2. Does it have a moat?

3. What does the future hold for the company?

4. Earnings growth.

5. Free cash flow.......and can it pay off debt with the free cash flow in a few short years.

6. What price am I comfortable buying in at?

But probably my biggest factors are:

1. Can I understand the business?

2. Does it have a moat?

3. What does the future hold for the company?

4. Earnings growth.

5. Free cash flow.......and can it pay off debt with the free cash flow in a few short years.

6. What price am I comfortable buying in at?

Canopy Growth, Acreage plan U.S. launch of cannabis-infused beverages in 2021

Acreage expects to launch Canopy's select, sessionable THC beverages in the summer of 2021 in legal adult-use markets in Illinois and California. "We see THC-infused beverages as a game-changer in U.S. cannabis, and we are excited to launch Canopy Growth's unique beverage offerings to our core...

Interesting bit of news.....might need verification. Apparently the US Market averages about a 2% return during the first year of a new POTUS. And with the economy.....next yr may suck. But it might be good buying opportunity.

Don't know OKE. Energy befuddles me.

Bought FTNT while selling ATVI. It had been good for me but I think FTNT will be a better investment especially at its current price.

Bought FTNT while selling ATVI. It had been good for me but I think FTNT will be a better investment especially at its current price.

My SPWH up 20.3% in a month since I bought, still $3-4 more per share perhaps, EDUC up nearly 5% in a week, looks like a steadily growing stock of a small company-kids’ quality books to read at home for fun and knowledge.

LEVI popped. Huge earnings beat. $16.22 after hours.Just purchased LEVI at $11.95/sh. Feeling good about future prospects.

Tomorrow should be interesting...

------------------------------------

All right. Let's see what you guys think about this:

I'm about to add to my ADSK position tomorrow but I saw that there is unusual options activity for the Oct 9 $210 put. 3100 open interest. The stock is at $228.

Any thoughts?

Edit: I checked an options calc and that drop is over 2SDs of change. They gave it 0% chance of happening. It's only a 7.9% change though.

------------------------------------

All right. Let's see what you guys think about this:

I'm about to add to my ADSK position tomorrow but I saw that there is unusual options activity for the Oct 9 $210 put. 3100 open interest. The stock is at $228.

Any thoughts?

Edit: I checked an options calc and that drop is over 2SDs of change. They gave it 0% chance of happening. It's only a 7.9% change though.

Last edited:

Looked at it. Liked some fundamentals. Backed out.Does anybody own OKE? I'm thinking about grabbing some shares. Any thoughts?

Supposedly, OKE gas volumes have been increasing. Might be worth a risk, even with a possible dividend cut. Winter is coming.

My sisters' and John Lennon's birthday. Could sell some upside calls if you think it's too risky at $228 but I'm not an options guy either.Tomorrow should be interesting...

------------------------------------

All right. Let's see what you guys think about this:

I'm about to add to my ADSK position tomorrow but I saw that there is unusual options activity for the Oct 9 $210 put. 3100 open interest. The stock is at $228.

Any thoughts?

Edit: I checked an options calc and that drop is over 2SDs of change. They gave it 0% chance of happening. It's only a 7.9% change though.

EDUC up another 10.7% this AM after its pre EPS report coming late next Tuesday. Still a young company and those with young kids should view its catalog of quality books for your young kids. My wife recently ordered a cheaper sticker book for our 3 year old autistic niece about animals and reptiles, can’t quit reading it herself, very educational.

finance.yahoo.com

finance.yahoo.com

Educational Development Corporation Announces Record Fiscal 2021 Second Quarter and Year to Date Results Along With Increase in Quarterly Dividend

TULSA, Okla., Oct. 07, 2020 (GLOBE NEWSWIRE) -- Educational Development Corporation (“EDC”, or the “Company”) (NASDAQ: EDUC) (http://www.edcpub.com) today reports record net revenues and earnings per share results for the second quarter and year to date ended August 31, 2020. Randall White, CEO...

Last edited:

I'm not knowledgeable enough to give stock tips, but I purchased Peloton (PTON) two weeks ago and it's made me almost 20% since then. Another educational stock to watch is EDUC.

Did you read my comment above on EDUC? Awesome products for kids eventually mean a solid stock.I'm not knowledgeable enough to give stock tips, but I purchased Peloton (PTON) two weeks ago and it's made me almost 20% since then. Another educational stock to watch is EDUC.

I bought anyway. If it goes to 210, so be it. In 10 years it'll be a blip.My sisters' and John Lennon's birthday. Could sell some upside calls if you think it's too risky at $228 but I'm not an options guy either.

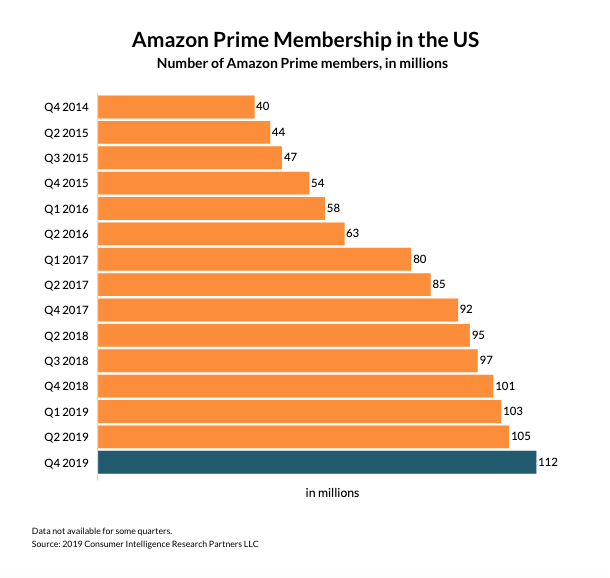

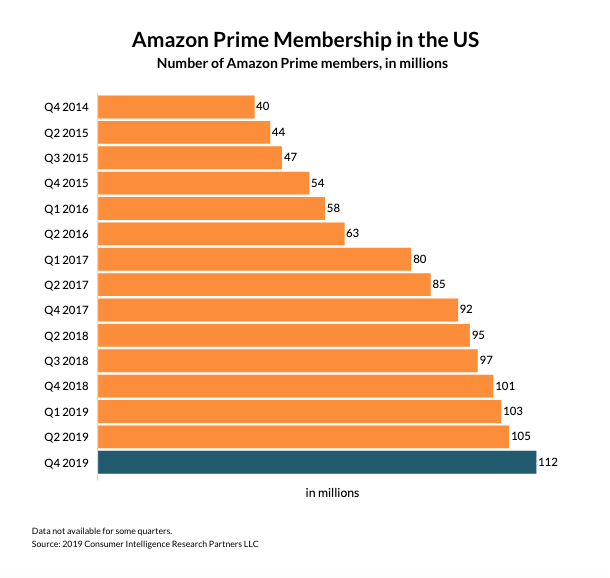

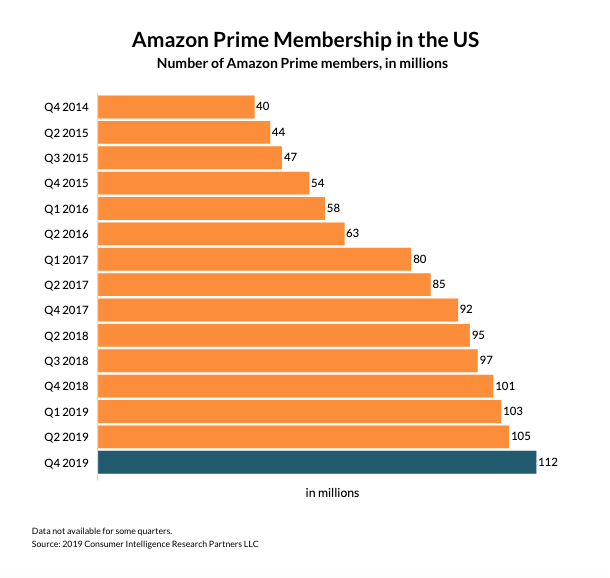

Right now, I'm bullish on Walmart.

While it's grown nicely over the last decade, I think the best is yet to come. Little by little they've been changing their business model. They want to challenge Amazon in online sales. COVID has forced them to adapt to grocery pick up. Etc, etc.

seekingalpha.com

seekingalpha.com

www.foxbusiness.com

www.foxbusiness.com

While it's grown nicely over the last decade, I think the best is yet to come. Little by little they've been changing their business model. They want to challenge Amazon in online sales. COVID has forced them to adapt to grocery pick up. Etc, etc.

Walmart Sees Rapid Adoption Of Walmart+ Subscriptions, Potential Impact On Q4 2021 And Beyond (NYSE:WMT)

Walmart is seeing rapid adoption of its Walmart Plus (W+) subscription service, with 11% of survey respondents saying they've already signed up.

Walmart unveils store design with self-checkout kiosks, contactless options rolling out to Supercenters

Self-checkout kiosks and contactless payment options are a part of Walmart's new store design rolling out to 200 stores by early next year.

www.usatoday.com

Why Walmart is winning in online grocery services: Report

Walmart’s physical locations, merged shopping apps and Express Delivery have made it successful during the coronavirus, according to a recent report.

Any recommendations on a 5G ETF or no load mutual fund?

FIVG. It’s a very original name.

and ticker symbol.FIVG. It’s a very original name.

KR is doing similar things out of necessity. The Marketplace store I frequent now offers delivery, free pickup, free wifi to check coupons, recipes, rewards, prescriptions, Little Clinic appointments and contactless payments by scanning credit card or mobile payment QR codes on your phone.Right now, I'm bullish on Walmart.

While it's grown nicely over the last decade, I think the best is yet to come. Little by little they've been changing their business model. They want to challenge Amazon in online sales. COVID has forced them to adapt to grocery pick up. Etc, etc.

Walmart Sees Rapid Adoption Of Walmart+ Subscriptions, Potential Impact On Q4 2021 And Beyond (NYSE:WMT)

Walmart is seeing rapid adoption of its Walmart Plus (W+) subscription service, with 11% of survey respondents saying they've already signed up.seekingalpha.com

Walmart unveils store design with self-checkout kiosks, contactless options rolling out to Supercenters

Self-checkout kiosks and contactless payment options are a part of Walmart's new store design rolling out to 200 stores by early next year.www.usatoday.com

Why Walmart is winning in online grocery services: Report

Walmart’s physical locations, merged shopping apps and Express Delivery have made it successful during the coronavirus, according to a recent report.www.foxbusiness.com

My KR is inflexible, request anything and the local management’s hands have been tied by the home office for many years. I once asked why there were several rows of a particular brand that wasn’t popular, yet only one row of the brand locals bought fast every week. He just grinned and shrugged “I said I know, inventory selection is out of your control locally.” Some of the Kroger brand cheeses started going bad on us after a few days about once a month despite great expiration dates, no refund once you take them out of the store, so we get cheese at Aldi now. Unhappy, but no real competition locally.

Hmm, I've never had an issue with refunds. Meat and dairy is where they usually shine as well. I took back a stale box of Kroger brand grahams crackers 2 weeks ago just one day before expiration and they will either replace it or refund my money. If something scans wrong, I take it to the service desk and get it free or $5.00 and a new item if it costs over that amount.My KR is inflexible, request anything and the local management’s hands have been tied by the home office for many years. I once asked why there were several rows of a particular brand that wasn’t popular, yet only one row of the brand locals bought fast every week. He just grinned and shrugged “I said I know, inventory selection is out of your control locally.” Some of the Kroger brand cheeses started going bad on us after a few days about once a month despite great expiration dates, no refund once you take them out of the store, so we get cheese at Aldi now. Unhappy, but no real competition locally.

Of course they have competition here, even in their home city. In fact, Target is in the same shopping center as my store. Fresh Thyme is across the street. Aldi is a half mile away tops.

Look closely at any Kroger brand block cheese if you buy it.Hmm, I've never had an issue with refunds. Meat and dairy is where they usually shine as well. I took back a stale box of Kroger brand grahams crackers 2 weeks ago just one day before expiration and they will either replace it or refund my money. If something scans wrong, I take it to the service desk and get it free or $5.00 and a new item if it costs over that amount.

Of course they have competition here, even in their home city. In fact, Target is in the same shopping center as my store. Fresh Thyme is across the street. Aldi is a half mile away tops.

WKHS and DHCP....patience appears ready to pay off. Both up over 10% today on date set for DHCP merger vote and WKHS USPS contract speculation. My first big single stock rodeo and I learned a lot.

I haven't in a while but every Kroger brand I buy says Quality Guaranteed with an 800 number on it. Doesn't mean I'll buy it though. Especially if I don't like it or it's a hassle to return. I've just never had the return issue. Although many store brands are good, all aren't. Their vanilla wafers are turrible.Look closely at any Kroger brand block cheese if you buy it.

JNJ down less than 2% on the Covid trial news. Probably has to be bought now after earnings. We'll see.

I bought about 20 shares of Nio yesterday........boom, today up 17.5%.

*update*......now over 23% for the day.

*update*......now over 23% for the day.

Last edited:

-Looked at NIO. Probably buy in if it ever drops. It's been on the watch list.

-Looking at AMWL, similar to TDOC. Not a question of if I buy, but when.

-BAC looking really good now. JPM as well. I think they put plenty aside for the forecasted downturn. WFC, not so much.

-Looking at AMWL, similar to TDOC. Not a question of if I buy, but when.

-BAC looking really good now. JPM as well. I think they put plenty aside for the forecasted downturn. WFC, not so much.

-Looked at NIO. Probably buy in if it ever drops. It's been on the watch list.

-Looking at AMWL, similar to TDOC. Not a question of if I buy, but when.

-BAC looking really good now. JPM as well. I think they put plenty aside for the forecasted downturn. WFC, not so much.

I too am looking at BAC. I bought JPM on the dip for ~$87.

I've heard that because the fed is going to hold interest rates down for years.......that it's going to hold banks down for a few yrs as well. Great to buy and hold.....but it'll take a while........i guess its more time to buy.

Last edited:

Just bought a couple shares of JD. I wanted to strengthen during a little pull back before the Holiday season.....and before earnings come out in December.

JD been berry, berry good to me.

Unfortunately I've only had very small position in it thus far. I'm looking to strengthen my position and hold long term.

Started very small but went with some growth and value this week.

INSG is a small cap 5G play whose chart looks like a trading vehicle.

M is brick and mortar of course and hasn't really broken out yet like some of the others in the space.

INSG is a small cap 5G play whose chart looks like a trading vehicle.

M is brick and mortar of course and hasn't really broken out yet like some of the others in the space.

Microsoft is partnering with SpaceX for the space sector.

seekingalpha.com

seekingalpha.com

Microsoft, Elon Musk's SpaceX partner to take Amazon rivalry to space (NASDAQ:MSFT) | Seeking Alpha

Microsoft's (NASDAQ:MSFT) Azure Space wants to attract commercial and government space business through partnerships that currently include helping to...

Lockheed Sees SpaceX As Bigger Threat In Top Growth Business; Earnings Beat

Lockheed Martin now sees its space business leading future revenue growth but acknowledged SpaceX has grown as a threat.

"IF" the rumors are true and we are close to another stimulus check.......what are you thinking of doing with it?

FYI, Supposedly the $ has changed from $1200 for adult.....and now $1000 for each child.

FYI, Supposedly the $ has changed from $1200 for adult.....and now $1000 for each child.

ADVERTISEMENT

ADVERTISEMENT