- New study finds that 53% of Millennials believe they will one day be millionaires

- Nearly 1-in-5 report that they they still rely on their parents for financial support

- They expect to retire at 56, though won't start saving for retirement until age 36

http://www.dailymail.co.uk/news/art...millionaires-someday-according-new-study.html

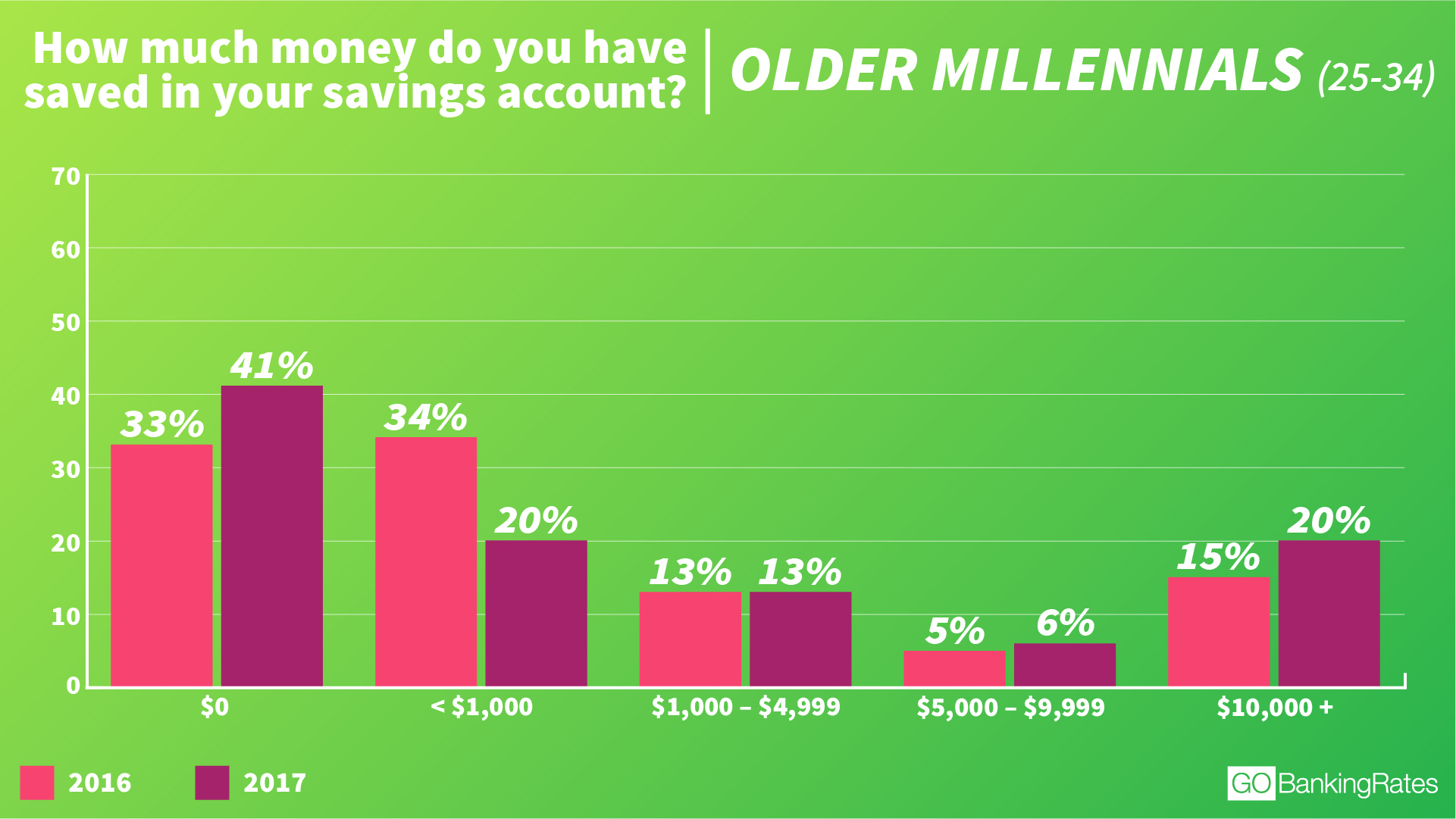

https://www.cnbc.com/2017/09/14/how-much-money-the-average-millennial-has-in-savings.html

Last edited: