Colleges

- AAC

- ACC

- Big 12

- Big East

- Big Ten

- Pac-12

- SEC

- Atlantic 10

- Conference USA

- Independents

- Junior College

- Mountain West

- Sun Belt

- MAC

- More

- Navy

- UAB

- Tulsa

- UTSA

- Charlotte

- Florida Atlantic

- Temple

- Rice

- East Carolina

- USF

- SMU

- North Texas

- Tulane

- Memphis

- Miami

- Louisville

- Virginia

- Syracuse

- Wake Forest

- Duke

- Boston College

- Virginia Tech

- Georgia Tech

- Pittsburgh

- North Carolina

- North Carolina State

- Clemson

- Florida State

- Cincinnati

- BYU

- Houston

- Iowa State

- Kansas State

- Kansas

- Texas

- Oklahoma State

- TCU

- Texas Tech

- Baylor

- Oklahoma

- UCF

- West Virginia

- Wisconsin

- Penn State

- Ohio State

- Purdue

- Minnesota

- Iowa

- Nebraska

- Illinois

- Indiana

- Rutgers

- Michigan State

- Maryland

- Michigan

- Northwestern

- Arizona State

- Oregon State

- UCLA

- Colorado

- Stanford

- Oregon

- Arizona

- California

- Washington

- USC

- Utah

- Washington State

- Texas A&M

- Auburn

- Mississippi State

- Kentucky

- South Carolina

- Arkansas

- Florida

- Missouri

- Ole Miss

- Alabama

- LSU

- Georgia

- Vanderbilt

- Tennessee

- Louisiana Tech

- New Mexico State

- Middle Tennessee

- Western Kentucky

- UTEP

- Florida International University

High School

- West

- Midwest

- Northeast

- Southeast

- Other

- Alaska

- Arizona

- California

- Colorado

- Nevada

- New Mexico

- Northern California

- Oregon

- Southern California Preps

- Washington

- Edgy Tim

- Indiana

- Kansas

- Nebraska

- Iowa

- Michigan

- Minnesota

- Missouri

- Oklahoma Varsity

- Texas Basketball

- Texas

- Wisconsin

- Delaware

- Maryland

- New Jersey Basketball

- New Jersey

- New York City Basketball

- Ohio

- Pennsylvania

- Greater Cincinnati

- Virginia

- West Virginia Preps

ADVERTISEMENT

Install the app

How to install the app on iOS

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature may not be available in some browsers.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Bitcoin and other crypto currency......

- Thread starter UK_Dallas

- Start date

Ran a few tests mining Monero and it appears promising. Pool-mined via moneropool.com for roughly 30 hours and earned 21 cents. $292.17 * 000721134252 XMR = 0.2105612.

Hardware setup is Intel i5 CPU on newer Dell laptop. Average hash rate = 47 h/s. Comparatively slow. Painful, actually.

Imagine scaling up to a dedicated GPU rather than CPU. Decent Nvidia 1050Ti card requires 135W and output = 13 Mh/s. Card costs ~$140.

Must run some more numbers. Looking at phase II soon.

Hardware setup is Intel i5 CPU on newer Dell laptop. Average hash rate = 47 h/s. Comparatively slow. Painful, actually.

Imagine scaling up to a dedicated GPU rather than CPU. Decent Nvidia 1050Ti card requires 135W and output = 13 Mh/s. Card costs ~$140.

Must run some more numbers. Looking at phase II soon.

Last edited:

Hey ATC, if you get the chance, could you spitball me some likely returns on a Commodore 64 with 56.6K (V.92 protocol) modem? TIA, man.Ran a few tests mining Monero and it appears promising. Pool-mined via moneropool.com for roughly 30 hours and earned 21 cents. $292.17 * 000721134252 = 0.2105612.

Hardware setup is Intel i5 CPU on newer Dell laptop. Average hash rate = 47 h/s. Comparatively slow. Painful, actually.

Imagine scaling up to a dedicated GPU rather than CPU. Decent Nvidia 1050Ti card requires 135W and output = 13 Mh/s. Card costs ~$140.

Must run some more numbers. Looking at phase II soon.

Litecoin? you should be smiling big time today

Good call.

I think it's rocketing because it's the first coin normies see other than BTC when they log into coinbase the first time

Ran a few tests mining Monero and it appears promising. Pool-mined via moneropool.com for roughly 30 hours and earned 21 cents. $292.17 * 000721134252 = 0.2105612.

Hardware setup is Intel i5 CPU on newer Dell laptop. Average hash rate = 47 h/s. Comparatively slow. Painful, actually.

Imagine scaling up to a dedicated GPU rather than CPU. Decent Nvidia 1050Ti card requires 135W and output = 13 Mh/s. Card costs ~$140.

Must run some more numbers. Looking at phase II soon.

CPU mining is a waste of time, and probably not particularly good for a laptop because of the heat it generates.

Just some ballpark numbers for you based on my current experiments - a 3GB GTX1060 ($230) will hash at about 420H/s on a slower pool like Minergate. About .004 XMR per day, and a profit of a little under $500 for a year.

I set the Wife's design PC up to mine when she's not using it, and with a Radeon RX580 8gb ($300 and up) it is doing a little under 600H/s, which would come out to about $620 a year, assuming no price changes in Monero.

Both will probably do much better using a dedicated console miner like Claymore, and that is the next step in the project - just haven't had the time to get them set up that way yet. Also pondering switching at least one of them to mining Zen, and I will probably be building a 4x GPU rig around the RX580s over the holiday shutdown with some bonus money for poops and grins.

Last edited:

I think it's rocketing because it's the first coin normies see other than BTC when they log into coinbase the first time

Yea the fact that it's one of only three coins traded on coinbase does give it some advantage over other CCs. Also Litecoin is basically Bitcoin 201, it's a new and improved version. If any other CC ever unthrowns Bitcoin I would say Litecoin would probably be the favorite.

I got about 10k in cryptocurrency.

Had 2.5k with lite around $98. I'm expecting it to go up to 1k in value. I don't think there's anything stopping it.

Had 2.5k with lite around $98. I'm expecting it to go up to 1k in value. I don't think there's anything stopping it.

The more I read about Bitcoin the more I think not only is Bitcoin not the future, Bitcoin is already obsolete. The technology of other crypto’s far outpaces Bitcoin. The Bitcoin blockchain at this point seems like it is very jerry-rigged and there are many add ons, workarounds, and side ledgers holding the thing together and making it work. Also transaction costs are skyrocketing and almost anyone who I hear tout the value of Bitcoin talks about no transaction costs being a benefit. When people become their own bankers and currency makers they find out how much it costs to do so and charge for it just like banks do.

A

anon_l8pbkn96tg3j6

Guest

Everyone who is invested and is paying attention probably agrees with you, and is probably cheering for a non-btc alternative to win. The one thing that is super easy to buy with btc is other cryptos, and I'd imagine most other crypto is owned by people who bought with btc.

Agreed on CPU mining as a time waster. This particular laptop is under warranty, has a suspected motherboard issue, and we're using it for test purposes anyway. Besides, it uses just one thread and remains fairly cool at 30% CPU utilization.CPU mining is a waste of time, and probably not particularly good for a laptop because of the heat it generates.

Just some ballpark numbers for you based on my current experiments - a 3GB GTX1060 ($230) will hash at about 420H/s on a slower pool like Minergate. About .004 XMR per day, and a profit of a little under $500 for a year.

I set the Wife's design PC up to mine when she's not using it, and with a Radeon RX580 8gb ($300 and up) it is doing a little under 600H/s, which would come out to about $620 a year, assuming no price changes in Monero.

Both will probably do much better using a dedicated console miner like Claymore, and that is the next step in the project - just haven't had the time to get them set up that way yet. Also pondering switching at least one of them to mining Zen, and I will probably be building a 4x GPU rig around the RX580s over the holiday shutdown with some bonus money for poops and grins.

Your feedback is tremendously appreciated. Time for us to "go into business" again and obtain another tax ID number.

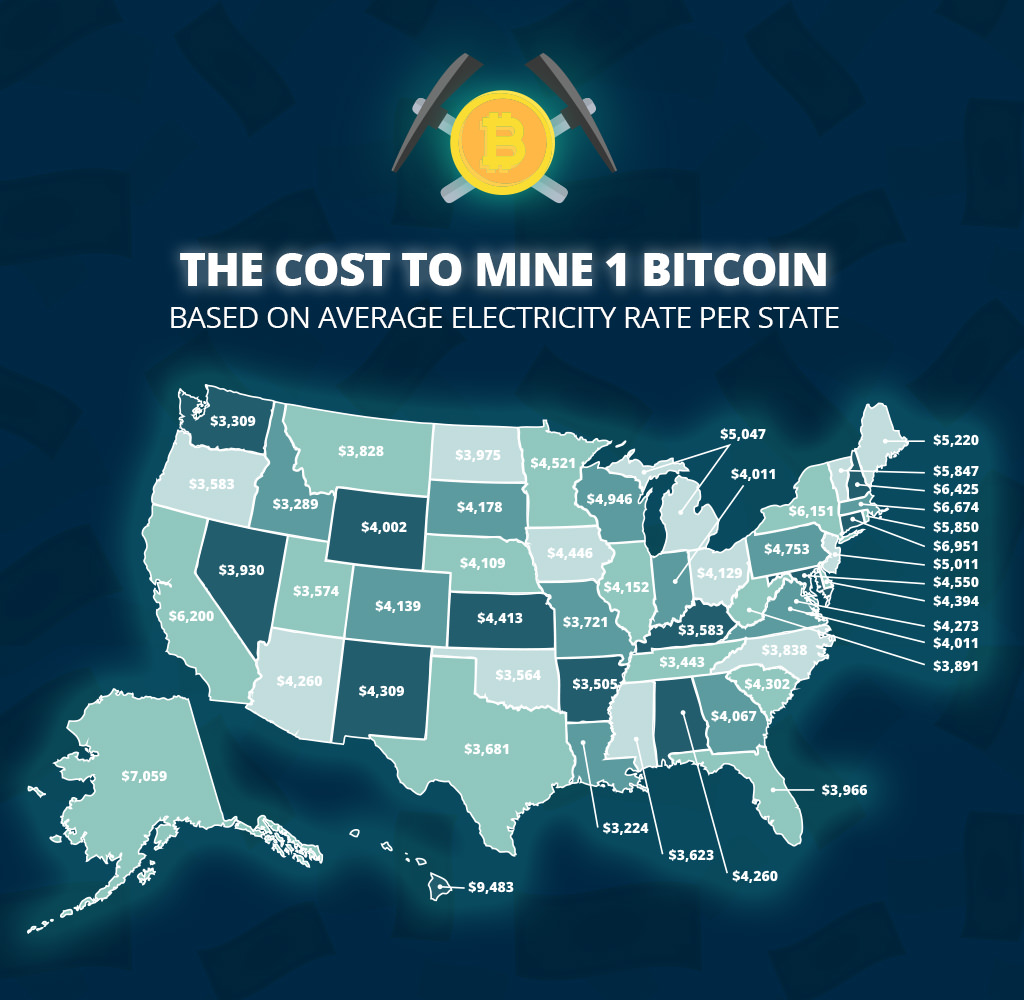

Historically in many cases you could have taken the upfront money you spent on hardware, and the incremental amount on electricity and bought bitcoin or other CCs instead and made more profit on the appreciation then you would from mining over time. The difference however is mining is lower risk because you are turning resources into something of value, not holding for appreciation.

Nonetheless if the cost of electricity could be mitigated or eliminated by using renewables it could be a viable business IMO. If I could see a comprehensive business plan that would show a good profit potential over time, I might be willing to put up some serious bucks for such a venture.

Nonetheless if the cost of electricity could be mitigated or eliminated by using renewables it could be a viable business IMO. If I could see a comprehensive business plan that would show a good profit potential over time, I might be willing to put up some serious bucks for such a venture.

The more I read about Bitcoin the more I think not only is Bitcoin not the future, Bitcoin is already obsolete. The technology of other crypto’s far outpaces Bitcoin. The Bitcoin blockchain at this point seems like it is very jerry-rigged and there are many add ons, workarounds, and side ledgers holding the thing together and making it work. Also transaction costs are skyrocketing and almost anyone who I hear tout the value of Bitcoin talks about no transaction costs being a benefit. When people become their own bankers and currency makers they find out how much it costs to do so and charge for it just like banks do.

Basically, but it was the first...so people hate to leave it. We already have Bitcoin Cash (BCH) and Bitcoin Gold (BTG) which where created from hard forks of Bitcoin. Both were done to fix existing issues with Bitcoin, but neither have really sky rocketed in value yet.

Most people tend to lean toward Ethereum as the future digital currency. Or Ripple since it's already been adopted by banks.

I think Bitcoin is about at it's bubble now, but we are just on the edge of digital currency exploding. When it's said and done, I think BTC will be the myspace of crypto currency. It was too far ahead of it's time and a victim of it's own success.

I came across this beauty of a prediction awhile back. Taken from an issue of The Economist in 1988. The Phoenix being a hypothetical name that BTC is now.

Title of article: Get Ready for the Phoenix

Source: Economist; 01/9/88, Vol. 306, pp 9-10

THIRTY years from now, Americans, Japanese, Europeans, and people in many other rich countries, and some relatively poor ones will probably be paying for their shopping with the same currency. Prices will be quoted not in dollars, yen or D-marks but in, let’s say, the phoenix. The phoenix will be favoured by companies and shoppers because it will be more convenient than today’s national currencies, which by then will seem a quaint cause of much disruption to economic life in the last twentieth century.

–

At the beginning of 1988 this appears an outlandish prediction. Proposals for eventual monetary union proliferated five and ten years ago, but they hardly envisaged the setbacks of 1987. The governments of the big economies tried to move an inch or two towards a more managed system of exchange rates – a logical preliminary, it might seem, to radical monetary reform. For lack of co-operation in their underlying economic policies they bungled it horribly, and provoked the rise in interest rates that brought on the stock market crash of October. These events have chastened exchange-rate reformers. The market crash taught them that the pretence of policy co-operation can be worse than nothing, and that until real co-operation is feasible (i.e., until governments surrender some economic sovereignty) further attempts to peg currencies will flounder.

The new world economy. The biggest change in the world economy since the early 1970’s is that flows of money have replaced trade in goods as the force that drives exchange rates. as a result of the relentless integration of the world’s financial markets, differences in national economic policies can disturb interest rates (or expectations of future interest rates) only slightly, yet still call forth huge transfers of financial assets from one country to another. These transfers swamp the flow of trade revenues in their effect on the demand and supply for different currencies, and hence in their effect on exchange rates. As telecommunications technology continues to advance, these transactions will be cheaper and faster still. With unco-ordinated economic policies, currencies can get only more volatile.

….

In all these ways national economic boundaries are slowly dissolving. As the trend continues, the appeal of a currency union across at least the main industrial countries will seem irresistible to everybody except foreign-exchange traders and governments. In the phoenix zone, economic adjustment to shifts in relative prices would happen smoothly and automatically, rather as it does today between different regions within large economies (a brief on pages 74-75 explains how.) The absence of all currency risk would spur trade, investment and employment.

–

The phoenix zone would impose tight constraints on national governments. There would be no such thing, for instance, as a national monetary policy. The world phoenix supply would be fixed by a new central bank, descended perhaps from the IMF. The world inflation rate – and hence, within narrow margins, each national inflation rate- would be in its charge. Each country could use taxes and public spending to offset temporary falls in demand, but it would have to borrow rather than print money to finance its budget deficit. With no recourse to the inflation tax, governments and their creditors would be forced to judge their borrowing and lending plans more carefully than they do today. This means a big loss of economic sovereignty, but the trends that make the phoenix so appealing are taking that sovereignty away in any case. Even in a world of more-or-less floating exchange rates, individual governments have seen their policy independence checked by an unfriendly outside world.

–

As the next century approaches, the natural forces that are pushing the world towards economic integration will offer governments a broad choice. They can go with the flow, or they can build barricades. Preparing the way for the phoenix will mean fewer pretended agreements on policy and more real ones. It will mean allowing and then actively promoting the private-sector use of an international money alongside existing national monies. That would let people vote with their wallets for the eventual move to full currency union. The phoenix would probably start as a cocktail of national currencies, just as the Special Drawing Right is today. In time, though, its value against national currencies would cease to matter, because people would choose it for its convenience and the stability of its purchasing power.

…..

The alternative – to preserve policymaking autonomy- would involve a new proliferation of truly draconian controls on trade and capital flows. This course offers governments a splendid time. They could manage exchange-rate movements, deploy monetary and fiscal policy without inhibition, and tackle the resulting bursts of inflation with prices and incomes polices. It is a growth-crippling prospect. Pencil in the phoenix for around 2018, and welcome it when it comes.

Not off much at all.

Title of article: Get Ready for the Phoenix

Source: Economist; 01/9/88, Vol. 306, pp 9-10

THIRTY years from now, Americans, Japanese, Europeans, and people in many other rich countries, and some relatively poor ones will probably be paying for their shopping with the same currency. Prices will be quoted not in dollars, yen or D-marks but in, let’s say, the phoenix. The phoenix will be favoured by companies and shoppers because it will be more convenient than today’s national currencies, which by then will seem a quaint cause of much disruption to economic life in the last twentieth century.

–

At the beginning of 1988 this appears an outlandish prediction. Proposals for eventual monetary union proliferated five and ten years ago, but they hardly envisaged the setbacks of 1987. The governments of the big economies tried to move an inch or two towards a more managed system of exchange rates – a logical preliminary, it might seem, to radical monetary reform. For lack of co-operation in their underlying economic policies they bungled it horribly, and provoked the rise in interest rates that brought on the stock market crash of October. These events have chastened exchange-rate reformers. The market crash taught them that the pretence of policy co-operation can be worse than nothing, and that until real co-operation is feasible (i.e., until governments surrender some economic sovereignty) further attempts to peg currencies will flounder.

The new world economy. The biggest change in the world economy since the early 1970’s is that flows of money have replaced trade in goods as the force that drives exchange rates. as a result of the relentless integration of the world’s financial markets, differences in national economic policies can disturb interest rates (or expectations of future interest rates) only slightly, yet still call forth huge transfers of financial assets from one country to another. These transfers swamp the flow of trade revenues in their effect on the demand and supply for different currencies, and hence in their effect on exchange rates. As telecommunications technology continues to advance, these transactions will be cheaper and faster still. With unco-ordinated economic policies, currencies can get only more volatile.

….

In all these ways national economic boundaries are slowly dissolving. As the trend continues, the appeal of a currency union across at least the main industrial countries will seem irresistible to everybody except foreign-exchange traders and governments. In the phoenix zone, economic adjustment to shifts in relative prices would happen smoothly and automatically, rather as it does today between different regions within large economies (a brief on pages 74-75 explains how.) The absence of all currency risk would spur trade, investment and employment.

–

The phoenix zone would impose tight constraints on national governments. There would be no such thing, for instance, as a national monetary policy. The world phoenix supply would be fixed by a new central bank, descended perhaps from the IMF. The world inflation rate – and hence, within narrow margins, each national inflation rate- would be in its charge. Each country could use taxes and public spending to offset temporary falls in demand, but it would have to borrow rather than print money to finance its budget deficit. With no recourse to the inflation tax, governments and their creditors would be forced to judge their borrowing and lending plans more carefully than they do today. This means a big loss of economic sovereignty, but the trends that make the phoenix so appealing are taking that sovereignty away in any case. Even in a world of more-or-less floating exchange rates, individual governments have seen their policy independence checked by an unfriendly outside world.

–

As the next century approaches, the natural forces that are pushing the world towards economic integration will offer governments a broad choice. They can go with the flow, or they can build barricades. Preparing the way for the phoenix will mean fewer pretended agreements on policy and more real ones. It will mean allowing and then actively promoting the private-sector use of an international money alongside existing national monies. That would let people vote with their wallets for the eventual move to full currency union. The phoenix would probably start as a cocktail of national currencies, just as the Special Drawing Right is today. In time, though, its value against national currencies would cease to matter, because people would choose it for its convenience and the stability of its purchasing power.

…..

The alternative – to preserve policymaking autonomy- would involve a new proliferation of truly draconian controls on trade and capital flows. This course offers governments a splendid time. They could manage exchange-rate movements, deploy monetary and fiscal policy without inhibition, and tackle the resulting bursts of inflation with prices and incomes polices. It is a growth-crippling prospect. Pencil in the phoenix for around 2018, and welcome it when it comes.

Not off much at all.

^Very interesting. It shows that people that understood monetary policy back then, saw the benefit of a world currency. The only thing they got wrong that I can see is the use of an alternative central bank, but then the technology for a blockchain network didn't exist in 1988.

^Very interesting. It shows that people that understood monetary policy back then, saw the benefit of a world currency. The only thing they got wrong that I can see is the use of an alternative central bank, but then the technology for a blockchain network didn't exist in 1988.

Yah I know, it's not 100 percent accurate. But not far off considering it was 1988 haha.

But the idea was firmly in place...

Taken from another article

Cryptocurrency’s technical foundations date back to the early 1980s, when an American cryptographer named David Chaum invented a “blinding” algorithm that remains central to modern web-based encryption. The algorithm allowed for secure, unalterable information exchanges between parties, laying the groundwork for future electronic currency transfers. This was known as “blinded money.”

By the late 1980s, Chaum enlisted a handful of other cryptocurrency enthusiasts in an attempt to commercialize the concept of blinded money. After relocating to the Netherlands, he founded DigiCash, a for-profit company that produced units of currency based on the blinding algorithm. Importantly, DigiCash’s control wasn’t decentralized, as is the case with Bitcoin and most other modern cryptocurrencies – DigiCash itself had a monopoly on supply control, similar to central banks’ monopoly on fiat currencies.

DigiCash initially dealt directly with individuals, but the Netherlands’ central bank cried foul and quashed this idea. Faced with an ultimatum, DigiCash agreed to sell only to licensed banks, seriously curtailing its market potential. Microsoft later approached DigiCash about a potentially lucrative partnership that would allow early Windows users to make purchases in its currency, but the two companies couldn’t agree on terms, and DigiCash went belly-up in the late 1990s.

https://www.moneycrashers.com/cryptocurrency-history-bitcoin-alternatives/

Dee, I've greatly admired your strategic view for many years. We're talking much respect. As previously stated, renewable energy, which I also completely embrace, probably will not work with KU Energy in SE KY unless major infrastructure improvements are made in the area OR one can assert some sort of really lucrative tax credits for onsite improvement.Historically in many cases you could have taken the upfront money you spent on hardware, and the incremental amount on electricity and bought bitcoin or other CCs instead and made more profit on the appreciation then you would from mining over time. The difference however is mining is lower risk because you are turning resources into something of value, not holding for appreciation.

Nonetheless if the cost of electricity could be mitigated or eliminated by using renewables it could be a viable business IMO. If I could see a comprehensive business plan that would show a good profit potential over time, I might be willing to put up some serious bucks for such a venture.

Check it out. Old, abandoned mines still exist in the area. Many of them. @Chuckinden can tell ya, the further back ya go in the (mountain, hill, etc), temperatures cool into the 50s (10 C) year round. Hell, we experienced 50s at the coal seam face when I worked for a mining company way back when. Problem is providing a safe environment so deep underground and combine it with connectivity. Then you deal with the humidity. I've been away from this underground business for many years, but combining renewable energy with crytocurrency mining in SE KY introduces too many variables.

I suggest my mom's house in Middlesboro because, while still in great shape, one could only scale up so much. And then summer comes, along with higher temps.

I'm really interested in this stuff more from a standpoint of my current portfolio of hard assets and future trades. Specifically if and when inflation takes hold and where the ancillary or counter trades may occur. I don't trade much frankly so I fear turning one into an investment like I did with Fitbit. Luckily I viewed it as pure speculation like hopefully most of ya'll do with CC's.

Dee, I've greatly admired your strategic view for many years. We're talking much respect. As previously stated, renewable energy, which I also completely embrace, probably will not work with KU Energy in SE KY unless major infrastructure improvements are made in the area OR one can assert some sort of really lucrative tax credits for onsite improvement.

Check it out. Old, abandoned mines still exist in the area. Many of them. @Chuckinden can tell ya, the further back ya go in the (mountain, hill, etc), temperatures cool into the 50s (10 C) year round. Hell, we experienced 50s at the coal seam face when I worked for a mining company way back when. Problem is providing a safe environment so deep underground and combine it with connectivity. Then you deal with the humidity. I've been away from this underground business for many years, but combining renewable energy with crytocurrency mining in SE KY introduces too many variables.

I suggest my mom's house in Middlesboro because, while still in great shape, one could only scale up so much. And then summer comes, along with higher temps.

I was thinking of something a bit more on a grander scale. Like getting a few acres in Arizona or New Mexico, putting in a solar farm, with DC/AC converters and sufficient backup battery subsystem so you could have a free standing mega coin-mining operation going 24x7x365, with 6 figure annual returns. No utility connections necessary. Add a desk, a coffee pot a, hire a couple of students at min wage to baby sit, and lit it rip.

Dee, I've greatly admired your strategic view for many years. We're talking much respect. As previously stated, renewable energy, which I also completely embrace, probably will not work with KU Energy in SE KY unless major infrastructure improvements are made in the area OR one can assert some sort of really lucrative tax credits for onsite improvement.

Check it out. Old, abandoned mines still exist in the area. Many of them. @Chuckinden can tell ya, the further back ya go in the (mountain, hill, etc), temperatures cool into the 50s (10 C) year round. Hell, we experienced 50s at the coal seam face when I worked for a mining company way back when. Problem is providing a safe environment so deep underground and combine it with connectivity. Then you deal with the humidity. I've been away from this underground business for many years, but combining renewable energy with crytocurrency mining in SE KY introduces too many variables.

I suggest my mom's house in Middlesboro because, while still in great shape, one could only scale up so much. And then summer comes, along with higher temps.

Atc I *think* deefense might be thinking of something on a grander scale.

Ah, gotcha. I thought more along the lines of starting with a few dozen mining rigs. Afterwards, dig (blast) out a chamber in that big-ass, steep hill located 5 feet behind mom's. Latitude sucks for solar and I believe wind is not an option based in wind maps I've seen. Anyway, fence it off and grow ginseng, too.I was thinking of something a bit more on a grander scale. Like getting a few acres in Arizona or New Mexico, putting in a solar farm, with DC/AC converters and sufficient backup battery subsystem so you could have a free standing mega coin-mining operation going 24x7x365, with 6 figure annual returns. No utility connections necessary. Add a desk, a coffee pot a, hire a couple of students at min wage to baby sit, and lit it rip.

It may work in theory. Low humidity. Be a pain to keep cool.

Here in ATX, we can now choose renewable energy providers. I believe Georgetown TX, which lies 20 miles north, is close to 100% wind-powered via turbines located a bit west.

Drop probably in response to Charlie Munger's comments about "total insanity" behind bitcoin.

<- - - - Plan on ordering parts for a mining rig next week.

<- - - - Plan on ordering parts for a mining rig next week.

So no one wants to talk about this HUGE drop in Bitcoin?

F that. All my crypto is going towards Kaizershillings.

Coinbase having major issues today. Not built for this volume perhaps.

A bull in BTC thinks it can go down to $8000 but sees it at $40,000 ultimately. I'm still wondering what the best play is with blockchain technology moreso than the currency. Same question with cannabis legislation passing across the west. Where are those Intel's and Cisco's that I can buy??

A bull in BTC thinks it can go down to $8000 but sees it at $40,000 ultimately. I'm still wondering what the best play is with blockchain technology moreso than the currency. Same question with cannabis legislation passing across the west. Where are those Intel's and Cisco's that I can buy??

Last edited:

Dumb question, is there an easy way to short Bitcoin? What site to use? Or can my brokers do that for me?

Obviously I missed the upswing and props to you guys if you hit it. I’m pretty hands off with my investment portfolio but generally always felt if there’s a stampede in one direction it’s time to head the other way.

So no one wants to talk about this HUGE drop in Bitcoin?

It was overheating, I expected a correction but not this soon, I felt that it would stay in the high teens until the Amazon announcement on Feb 2, but a 30% correction is not really a shock. Gotta take the long term view IMO.

Hear do about bitcoin many years ago now everyone talks about it and I hate myself for it cuz someone who I'd take would be the type of guy to not listen to told me about it.

Would it be smart to to still invest in?It was overheating, I expected a correction but not this soon, I felt that it would stay in the high teens until the Amazon announcement on Feb 2, but a 30% correction is not really a shock. Gotta take the long term view IMO.

In the eternal words of Randy Moss: "Straight cash, homey."

Does anyone think that the United States of America is going to let its best and biggest hustle (the omnipresence of the dollar as the most important currency in the world) fall to a bunch of un-organized dweebs trying to arbitrage electricity and humidity rates in order to "mine" some fictional currency with no actual worth other than speculating against ever greater fools?

That ain't the way the world works.

Does anyone think that the United States of America is going to let its best and biggest hustle (the omnipresence of the dollar as the most important currency in the world) fall to a bunch of un-organized dweebs trying to arbitrage electricity and humidity rates in order to "mine" some fictional currency with no actual worth other than speculating against ever greater fools?

That ain't the way the world works.

Yeah, that’s the thing.

This is a party where it’s probably ok to be fashionably late, but you want to be able to get out unnoticed well before things start dying out.

It’s an easily manipulated market, where your investment is going to be subject to the whims of the “whales” who can easily trigger a sell off like yesterday then rebuy, buy more coins at a discount to strengthen their positions further and horde more coins.

The smart gamble is to buy the dips and get out, not take a long term idealistic view... but who knows for how long, maybe the gettins” good for a few more years, maybe a few more weeks.

This is a party where it’s probably ok to be fashionably late, but you want to be able to get out unnoticed well before things start dying out.

It’s an easily manipulated market, where your investment is going to be subject to the whims of the “whales” who can easily trigger a sell off like yesterday then rebuy, buy more coins at a discount to strengthen their positions further and horde more coins.

The smart gamble is to buy the dips and get out, not take a long term idealistic view... but who knows for how long, maybe the gettins” good for a few more years, maybe a few more weeks.

It is pure speculation because there is no underlying intrinsic asset. I'm not saying that there is not money to be made on it but people need to realize that is quite literally a Greater Fool play.

In order to intelligently purchase bitcoin to make money, you have to believe that someone stupider than you will be willing to pay more for a bitcoin in the future than you and that amount will be high enough to justify your outlay of capital and labor as weighed against the expected return you could get elsewhere (like say simple-ass US stock index funds which went through the roof because the economy is strong.)

As the Chuck E Cheese coin story above demonstrates, that is not necessarily a bad bet but it sure as hell isn't an investment.

Another issue is that the kinds of people these types of things attract tend to be some combination of criminal or autistic or freeloader. A currency is only really worth the trust that people have in it and the intrinsic assets backing it.

If you've got trust in some bullshit cryptocurrency created by hucksters that has utterly nothing backing it, you're a sucker and you shouldn't kid yourself by thinking anything other than that the only way to make money is to find someone even more gullible than you are because you've been had, son.

In order to intelligently purchase bitcoin to make money, you have to believe that someone stupider than you will be willing to pay more for a bitcoin in the future than you and that amount will be high enough to justify your outlay of capital and labor as weighed against the expected return you could get elsewhere (like say simple-ass US stock index funds which went through the roof because the economy is strong.)

As the Chuck E Cheese coin story above demonstrates, that is not necessarily a bad bet but it sure as hell isn't an investment.

Another issue is that the kinds of people these types of things attract tend to be some combination of criminal or autistic or freeloader. A currency is only really worth the trust that people have in it and the intrinsic assets backing it.

If you've got trust in some bullshit cryptocurrency created by hucksters that has utterly nothing backing it, you're a sucker and you shouldn't kid yourself by thinking anything other than that the only way to make money is to find someone even more gullible than you are because you've been had, son.

Would it be smart to to still invest in?

Personally I'm still vary bullish on bitcoin, as I think the fundamentals all point to continued acceptance, however if I were getting in today, I would probably spread my investment around more into what I call the second tier coins like euthereum, lite coin and bitcoin cash, as I think they may have more immediate upside.

I think cryptocurrancies will someday be the internet of money.

It is pure speculation because there is no underlying intrinsic asset

What value is there in any fiat currency? Nothing backs up the US dollar, the federal reserve can authorize the printing of as much of it as it wants. The only thing that gives the dollar value is the acceptance and demand for it.

I would argue that there is intrinsic value in cryptocurrancy because if you own any, you "own" a part of a complex blockchain network, which has value. The advantages of CCs over any fiat currency creates demand which causes the value to increase.

Similar threads

- Replies

- 34

- Views

- 722

- Replies

- 46

- Views

- 3K

- Replies

- 4

- Views

- 309

- Replies

- 5

- Views

- 287

- Replies

- 15

- Views

- 1K

ADVERTISEMENT

ADVERTISEMENT